Author: JDevtech – Jan 6, 2020

Litecoin (LTC) the 6th largest Cryptocurrency by Market Capitalization breaks $600 on BitMex trading platform.

Litecoin (LTC) aficionados were pleasantly surprised on December 25, 2020 when LTC, the 6th largest cryptocurrency by market capitalization, surpassed all other top 10 coins with a 30% rise for the day.

Bitcoin and the cryptocurrency market as a whole has been trending upwards since October 12, 2020 following the announcement that PayPal Holdings Inc (NASDAQ: PYPL) would be enabling its customers to buy, hold and sell cryptocurrency directly from their PayPal accounts.

Since then Bitcoin has seen the shattering of previous all time highs. What’s even more interesting about the PayPal catalyst is there are only 4 cryptocurrencies that will be supported. Among these are Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

What does this translate to for Litecoin? PayPal has a user base of 286 million users. Most of these users have never used cryptocurrency and often have only heard of Bitcoin. New retail investors will be introduced to all 4 of these cryptocurrencies. LTC being the most inexpensive, would most likely be the most attractive to some who might not want to invest too much but still own an entire coin.

$600+ Litecoin – A Glimpse into the Future?

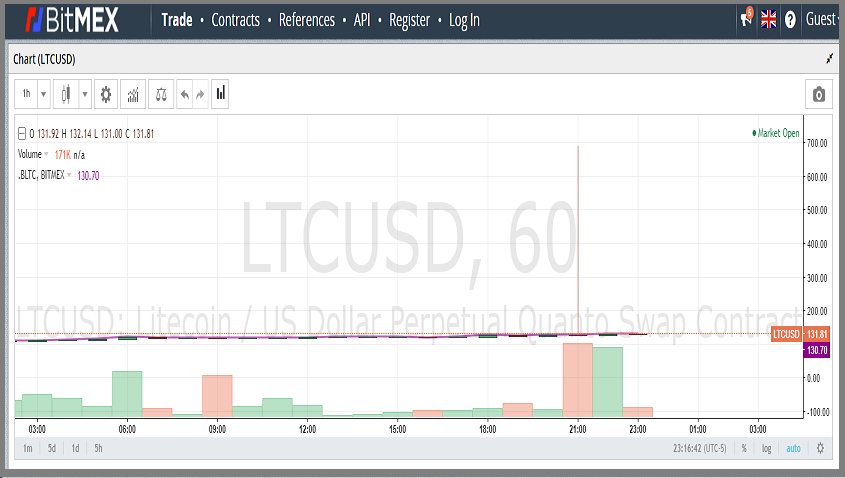

Litecoin has been trending upwards since October 2020 but interest in LTC has been gaining serious momentum since mid December when the value spiked 71.5% from $71.46 (397,413 satoshis) to $122.57 (519,888 satoshis) within 10 days. The current price, at the time of writing this article, is a whopping $167.

This is still a far cry from its December 2017 price of $335 (1,932,112 satoshis), but is it possible to reach that mark again or even surpass it? On December 25th 2020 Litecoin briefly hit a whopping $688 (2,767,275 satoshis) on the Bitmex trading platform. While this was probably a fatfinger trade, is it a sign of what’s to come?

Litecoin: Investor Demand

Institutional investors have been interested in Bitcoin now more than ever before as we have seen with the recent influx of large investment banks purchasing Bitcoin. Grayscale Investment LLC (GBTC) was one of the first to create a Bitcoin Investment Trust. This allows investors to use monies from various retirement accounts and invest in cryptocurrencies indirectly.

Grayscale Investment LLC also introduced the Grayscale Litecoin Trust (LTCN) in March of 2018. Since then the price has blown up from $20 to a peak of $500, but has since settled down to $362. Currently the actual value of the underlying LiteCoin (LTC) being held is $14.36. What does that mean? It means investors are so interested in retaining Litecoin in their portfolio that they are paying a 24x premium in order to do so.

Bottom line is Litecoin demand is very high, and looking at the performance of LTCN it may soon be a household name similar to Bitcoin.

Well written article. I feel as though new investors in the space want “entire coins” and won’t quite understand that fractions of a coin like BTC is still something of great value. They will see BTC as being “untouchable” right now due to the price and decide to buy a more affordable and attainable coin, such as LTC.

LTC TOO THE MOOOOON!!!!